You’re standing at a financial crossroads, aren’t you? The question isn't just "Should I rent or buy?" it’s "Where, when, and how does this decision impact my life, my wallet, and my future?" Housing costs are soaring, and the national headlines paint a grim picture: a median US home price topping $420,000, while median two-bedroom rent hovers near $1,950 a month. But here’s the crucial insight: national averages are like looking at the entire ocean and trying to describe a single wave. The real story of Housing Costs & Rent vs. Buy Decisions is intensely local, shifting dramatically from one zip code to the next.

This isn't just about spreadsheets; it's about lifestyle, flexibility, wealth building, and finding peace of mind in a volatile market. Let's unpack it all, city by city, factor by factor, so you can make the most informed decision for your unique situation.

At a Glance: Navigating Your Housing Choice

- It's Hyperlocal: National averages mask huge differences. Your city's prices, taxes, and job market dictate your best move.

- Time is Money: Owning usually makes financial sense if you plan to stay 5-7 years or more.

- Upfront Costs are Key: Buying demands a significant down payment and closing costs that renting doesn't.

- Beyond the Mortgage: Homeownership includes property taxes, insurance, and often substantial maintenance.

- Flexibility vs. Equity: Renting offers mobility; buying builds long-term wealth (if managed well).

- Interest Rates Matter: High rates can significantly alter the "buy" math, making renting more attractive even for longer stays.

- Creative Solutions: If both feel out of reach, shared housing, expanding your search, or even strategic relocation are valid paths.

The Illusion of the National Average: Why Your City Matters Most

Forget what you see on cable news about "the housing market." While it's true that affordability nationwide is at its lowest in decades, what truly impacts your decision is the ground beneath your feet. A $420,000 median home price or $1,950 median two-bedroom rent tells you nothing about whether you should buy a condo in Chicago or lease an apartment in San Francisco.

Consider the stark contrast: in New York City, a median home costs around $750,000, with a two-bedroom apartment renting for about $3,200. In Cleveland, you might find a median home for under $200,000, while a two-bedroom goes for $1,200. These aren't minor differences; they fundamentally reshape the rent vs. buy equation.

This isn't about simply adding up monthly payments. It's about weighing property taxes, insurance, maintenance, potential appreciation, and the sheer cultural weight of homeownership versus the liberating flexibility of renting.

Beyond the Sticker Price: Unpacking the True Costs

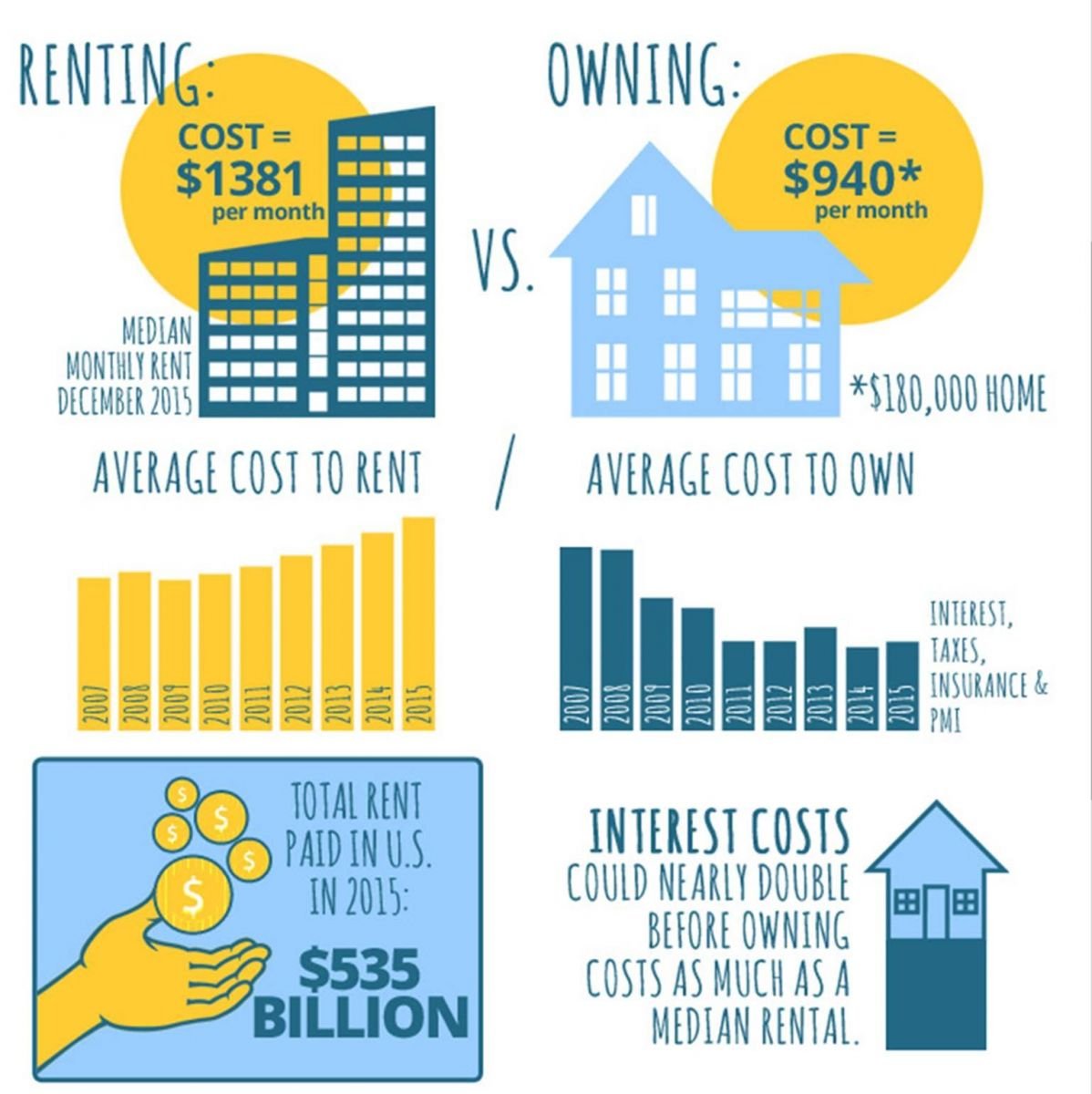

The "rent vs. buy" calculator often starts with comparing a monthly mortgage payment to a monthly rent check. But that’s just the cover of the book. To truly understand the financial commitment, you need to dive deeper.

The True Cost of Renting

Renting often feels straightforward: one check, typically. But it's more than that.

- Monthly Rent: Your primary, predictable expense.

- Utilities: Electricity, gas, water, internet – can vary widely.

- Renter's Insurance: A small, but crucial, cost to protect your belongings.

- Security Deposit: An upfront cost, usually refundable, but it's cash out the door initially.

- Application Fees/Broker Fees: Can be significant, especially in competitive markets like NYC.

- Opportunity Cost: The money you're not building into equity or appreciating assets.

The Upside: Renting offers unparalleled flexibility. Want to move for a new job in six months? Need more space for a growing family next year? With a lease, your commitment is generally limited. This mobility can be invaluable, especially in dynamic job markets or for those who prioritize a low-stress lifestyle, free from the unexpected costs of homeownership.

The True Cost of Buying: Beyond the Mortgage

Buying a home is a multi-headed beast of expenses. The principal and interest (P&I) payment on your mortgage is just one part.

- Down Payment: Often the biggest hurdle. 20% is ideal to avoid Private Mortgage Insurance (PMI), but many loans allow less (3-5%). On a $400,000 home, 20% is $80,000 cash upfront.

- Closing Costs: These are fees paid at the close of the real estate transaction, typically 2-5% of the loan amount. Think loan origination fees, appraisal fees, title insurance, recording fees, and more. On that $400,000 home, that’s another $8,000-$20,000.

- Property Taxes: These are non-negotiable and vary wildly by state and even county. In Chicago, property tax rates hover around 2%, meaning a $330,000 home could come with an annual tax bill of $6,600 – a substantial monthly addition. Compare that to Phoenix, where the average rate is a low 0.6%, dramatically reducing the ownership burden.

- Homeowner's Insurance: Protects your asset against fire, theft, natural disasters. If you live in a climate-risk prone area, this cost can be steep and rising.

- Private Mortgage Insurance (PMI): If you put down less than 20%, lenders require PMI, an extra monthly fee until you reach 20% equity.

- Homeowners Association (HOA) Fees: If you buy a condo or a home in a planned community, these monthly fees cover shared amenities and maintenance. They can range from negligible to hundreds of dollars.

- Maintenance & Repairs: This is the hidden monster. Experts often recommend budgeting 1-3% of your home's value annually for maintenance. On a $400,000 home, that's $4,000-$12,000 a year for everything from a leaky faucet to a new roof or HVAC system. When you rent, your landlord handles these.

- Utilities & Upgrades: You’re now responsible for everything. Want to upgrade the kitchen or paint a room? It's on your dime.

- Interest Rates: Crucially, the current interest rate environment significantly impacts your monthly mortgage payment and the total cost of your loan over its lifetime. A difference of even 1% can add tens of thousands to your total interest paid.

When you add up the down payment, closing costs, and ongoing expenses like taxes, insurance, and maintenance, the financial commitment to buying often dwarfs the initial perception of "just a mortgage payment."

The Local Lens: City-Specific Scenarios (2025 Estimates)

Let's look at how these factors play out in real cities.

Where Renting Often Wins: The High-Cost Hubs

In cities with stratospheric property values and competitive rental markets, renting can often be the smarter financial move, especially in the short to medium term.

- New York City: Median home price ~$750,000; median 2BR rent ~$3,200.

- Why renting often wins: The sheer down payment required for a $750k property is immense. Add property taxes around 1.2%, maintenance, and the fact that many rentals benefit from rent regulation, and ownership becomes a colossal undertaking. The monthly costs of owning a median home would easily double or triple the equivalent rent.

- San Francisco: Median home price ~$1.3 million; median 2BR rent ~$3,800.

- Why renting usually wins: Unless you're in the ultra-high income bracket, ownership costs are prohibitive. A $1.3 million home with a 20% down payment (a quarter-million dollars!) would still leave a mortgage payment north of $7,500/month, not including property taxes (~1.1%) and other costs. While ownership can build long-term wealth due to rapid appreciation, the barrier to entry is immense. Renting provides access to the city's opportunities without the crushing financial burden.

- Los Angeles: Median home price ~$900,000; median 2BR rent ~$3,000.

- Why renting may be better short-term: LA is a sprawling beast. Owning a median home means a significant mortgage. While buying offers long-term equity, the upfront costs and high property values can make renting more practical initially. Commuting costs are a critical factor here; cheaper homes often mean longer drives from inland areas, adding thousands annually in gas and lost time. Property taxes average around 1.2%.

Where it's a Toss-Up: The Balancing Act

Some markets present a more nuanced picture, where the decision often comes down to individual financial situations and preferences.

- Chicago: Median home price ~$330,000; median 2BR rent ~$2,000.

- Why it's a tie: Chicago offers relatively more accessible home prices than coastal giants. However, it boasts one of the highest property tax rates in the nation, often around 2%. This significantly inflates the true cost of ownership. For a $330,000 home, that's $6,600 annually in taxes alone. Your tolerance for high property taxes, combined with current interest rates, will often tip the scales here.

Where Buying Often Wins: The Equity Growers

In markets with strong job growth, relatively more accessible prices, and reasonable property taxes (or a good balance), buying often proves to be the stronger long-term strategy.

- Austin: Median home price ~$475,000; median 2BR rent ~$2,200.

- Why buying often wins: Austin has seen massive price increases (doubling over the last decade), driven by tech and population growth. Despite this, ownership still often wins for long-term equity growth. Property taxes average around 1.6%, higher than some, but offset by strong appreciation potential and a vibrant job market.

- Phoenix: Median home price ~$430,000; median 2BR rent ~$2,000.

- Why buying wins for long-term stays: Phoenix has also experienced significant price growth (nearly doubled since 2010). For those planning to stay long-term, buying offers considerable equity growth. Property taxes are relatively low, averaging 0.6%. However, Phoenix faces increasing climate risks (extreme heat, water scarcity) which can add to homeowner costs (e.g., higher utility bills, specific landscaping, insurance). Renters retain the flexibility to relocate if these costs become too burdensome.

- Dallas-Fort Worth: Median home price ~$360,000; median 2BR rent ~$2,000.

- Why buying is often favored: With strong job growth and relatively moderate home prices for a major metro, ownership remains accessible. Property taxes average around 1.8%, which is a factor, but the overall market dynamics often favor buying for those looking to build equity.

Where Buying Almost Always Wins: The Affordable Havens

In some regions, the financial math for buying is so compelling that a mortgage payment can genuinely be cheaper than rent, even when factoring in all ownership costs.

- Cleveland and Midwest Cities (e.g., Detroit, St. Louis): Median home prices can be below $200,000; median 2BR rent ~$1,200.

- Why buying almost always wins financially: In many parts of the Midwest, home prices are significantly lower. A mortgage payment on a $200,000 home (even with higher property taxes around 1.4%) can easily be less than $1,200/month, leaving room for insurance and maintenance. The primary consideration here shifts from affordability to job market stability and long-term economic prospects. If your job is secure, these markets offer a clear path to homeownership and wealth building.

Beyond the Numbers: The Intangible Factors

The rent vs. buy decision isn't purely financial. Lifestyle, career goals, and even cultural expectations play a significant role.

The Power of the Job Market

A booming industry can drive prices sky-high, offering rapid appreciation for homeowners but inflicting sharp rent hikes on renters. Slower growth areas might mean more affordable homes but also limited appreciation potential. Your career trajectory and the stability of your local job market should heavily influence your choice. Are you likely to move for a better opportunity in a few years? Renting offers unmatched agility.

Climate Risks: A Growing Consideration

Homeowners in areas prone to climate risks (wildfires, floods, extreme weather) face escalating insurance premiums, potential non-renewals, and significant repair costs. Renters, while not immune to displacement, generally have greater flexibility to relocate and avoid these direct financial burdens and stressors. As you're making this crucial decision, consider the long-term environmental outlook of your chosen locale.

Transportation Costs: The Hidden Expense

In sprawling metropolitan areas, the hunt for more affordable homes often means moving further from city centers. This translates to longer commutes, which aren't just an inconvenience; they're a significant financial drain. Thousands annually in gas, vehicle maintenance, and lost time can quickly erode any savings from a cheaper mortgage. Renters often find they can afford to live closer to work, saving on these indirect costs.

Cultural Norms & Generational Perspectives

In some cities, like New York, renting is entirely normalized, even for high earners. In others, homeownership remains a strong cultural aspiration and a perceived benchmark of financial success.

Younger generations, like those Understanding older Gen Z, often prioritize flexibility, experiences, and a lower financial burden, making renting an attractive option. The idea of being "house poor" — owning a home but having little disposable income — is increasingly unappealing. This cultural shift means the psychological pressure to buy might be less intense for many, allowing for a more purely rational financial decision.

Migration Trends: Following the Crowds (or Avoiding Them)

Population shifts can dramatically alter housing demand and prices. Areas experiencing an influx of new residents often see rapid price appreciation and rental increases. Conversely, areas with declining populations might offer more affordable housing but less appreciation potential. Keeping an eye on these macro trends can provide valuable context for your local decision.

Tools and Frameworks for Your Decision

Now that we've covered the complexities, let's look at some practical tools to guide your decision.

The Magic Number: Expected Length of Stay

This is perhaps the single most critical factor. Financial experts generally agree: you typically need to stay in a home for at least 5-7 years for homeownership to be more financially advantageous than renting. This timeframe allows you to:

- Build enough equity to offset closing costs paid when you bought.

- Benefit from potential appreciation.

- Spread out the transaction costs (which are significant both when buying and selling).

If you anticipate moving for work, family, or personal reasons within a shorter period, renting almost always wins.

The Price-to-Rent Ratio: A Quick Litmus Test

A simple ratio can give you a starting point:

Price-to-Rent Ratio = Home Purchase Price / (Annual Rent)

- Traditionally, a ratio under 20 (meaning a home costs less than 20 times its annual rent) suggested buying might make sense.

- However, with today's higher interest rates, this ratio needs adjustment. A 6.00% mortgage significantly increases the cost of borrowing. In such an environment, a ratio closer to 14:1 or even lower might be more appropriate to make buying financially competitive with renting.

Let's revisit the national average: a $420,000 median home and $1,950/month median rent.

$420,000 / ($1,950 * 12) = $420,000 / $23,400 = ~17.95

This national average ratio suggests that buying could still be reasonable, but you'd need to consider your specific interest rate and local market dynamics to validate it. For instance, in a city like San Francisco, where a $1.3 million home rents for $3,800/month: $1,300,000 / ($3,800 * 12) = $1,300,000 / $45,600 = ~28.5. This high ratio strongly favors renting, confirming our earlier city-specific analysis.

The Breakeven Point: When Ownership Pays Off

The "breakeven point" is when the cumulative financial benefits of homeownership (equity growth, potential tax deductions, appreciation) outweigh the initial costs and ongoing savings from renting.

Consider the example: a $325,000 home with a 6.50% loan and 20% down, comparable to a $2,000/month rental. Our earlier quick calculation showed the total monthly ownership costs could be closer to $2,420 (including P&I, taxes, insurance, maintenance). This means you'd initially be paying about $420 more per month to own.

While the exact breakeven point calculation is complex (involving amortization schedules, estimated appreciation, tax benefits, and comparing investment alternatives for your down payment), the ground truth research suggests that for this scenario, the breakeven point could be around 14 years.

- What this means: For the first 14 years, you might actually be financially better off renting and investing the difference. After 14 years, the equity, appreciation, and other benefits of homeownership begin to significantly outweigh the cumulative costs.

- Interest Rate Impact: If interest rates drop dramatically, this breakeven period can shorten significantly, making buying attractive much sooner. This highlights how sensitive the decision is to the prevailing economic conditions.

Online rent vs. buy calculators can help you estimate your personal breakeven point, factoring in your specific numbers. Be sure to use a comprehensive calculator that includes all ownership costs.

When Both Feel Unaffordable: Strategies for the Modern Reality

For many, the current market makes both renting and buying feel like an uphill battle. If you're in this position, you're not alone, and there are proactive steps you can take.

1. Embrace Shared Housing

One of the most immediate and impactful strategies for reducing housing costs is to live with roommates. Splitting a two-bedroom apartment can be dramatically cheaper than renting a one-bedroom alone. For example, if a one-bedroom is $1,800/month and a two-bedroom is $2,200/month, splitting the two-bedroom saves you $700/month ($2,200/2 = $1,100 vs. $1,800). That's a potential savings of over $7,000 annually, which can be channeled into savings, debt repayment, or an investment fund.

2. Expand Your Search Area

Don't limit yourself to the trendiest or closest neighborhoods. Look just outside major cities for more affordable housing with reasonable commutes. A slightly longer drive or train ride might unlock significantly lower rents or more accessible home prices. Research emerging neighborhoods or those in adjacent towns that offer a better value proposition.

3. Consider Strategic Relocation

If your job allows for remote work, or if you're open to a career change, consider moving to a more affordable area. Many mid-sized cities and suburban towns offer a high quality of life with significantly lower housing costs. This is a big decision, but for some, it's the key to achieving financial goals that feel impossible in high-cost metros.

4. Boost Your Income, Trim Your Expenses

This timeless advice remains relevant.

- Negotiate Higher Pay: Research salary benchmarks for your role and industry, and advocate for what you're worth.

- Supplement Income: Explore side hustles, freelancing, or gig economy opportunities to bring in extra cash.

- Cut Expenses: Go through your budget with a fine-tooth comb. Look for subscriptions you don't use, areas where you can reduce discretionary spending, or opportunities to optimize recurring bills. Every dollar saved is a dollar that can go towards your housing goals.

Making Your Confident Decision

There's no single "right" answer to the rent vs. buy question. The optimal choice is deeply personal, shaped by your financial reality, career stage, family situation, and risk tolerance.

Start by being brutally honest with yourself about your finances. How much can you realistically save for a down payment and closing costs? What's your comfort level with ongoing maintenance surprises? How stable is your income?

Next, consider your lifestyle and time horizon. Do you crave the freedom to relocate, or do you dream of putting down roots and customizing your space? How long do you genuinely expect to stay in one place?

Finally, do your hyper-local research. Plug your specific numbers into a robust rent vs. buy calculator. Talk to real estate agents and lenders who specialize in your target area. Understand the property tax rates, typical maintenance costs, and appreciation trends specific to your city.

Armed with this comprehensive understanding, you can move forward with confidence, knowing you've considered all angles in your journey to finding your ideal home.